Preparing for the upcoming federal $2,000 payments scheduled for January 2026 can seem overwhelming. This blog post serves as your comprehensive guide, clarifying eligibility, outlining payment delivery methods, and providing proactive steps to ensure you easily track and claim your funds.

Understanding Federal $2,000 Payments for January 2026

If you’re expecting a $2,000 federal payment in January 2026, it’s essential to familiarize yourself with who qualifies, how the payments will be issued, and actionable steps you can take now to be prepared as the distribution date approaches.

Who is Eligible for the Federal Payment?

Eligibility for the federal $2,000 payments is primarily determined by federal legislation. Key factors include:

– Adjusted Gross Income (AGI) limits based on the most recent tax return or designated benefit record.

– Citizenship or qualifying resident status.

– Enrollment in specific federal benefits such as Social Security or veteran benefits, if payments are tethered to those programs.

Checking Your Eligibility for the Federal Payment

To verify your eligibility, utilize the official online portals or contact the program helpline. Have your identification and recent tax or benefits documentation at hand. Many agencies offer an eligibility checker or an FAQ page related to this payment.

Payment Delivery Methods

The delivery methods for the payments include:

– Direct Deposit: Most recipients will receive their funds directly into the bank account listed with the IRS or corresponding agency, which is the fastest option.

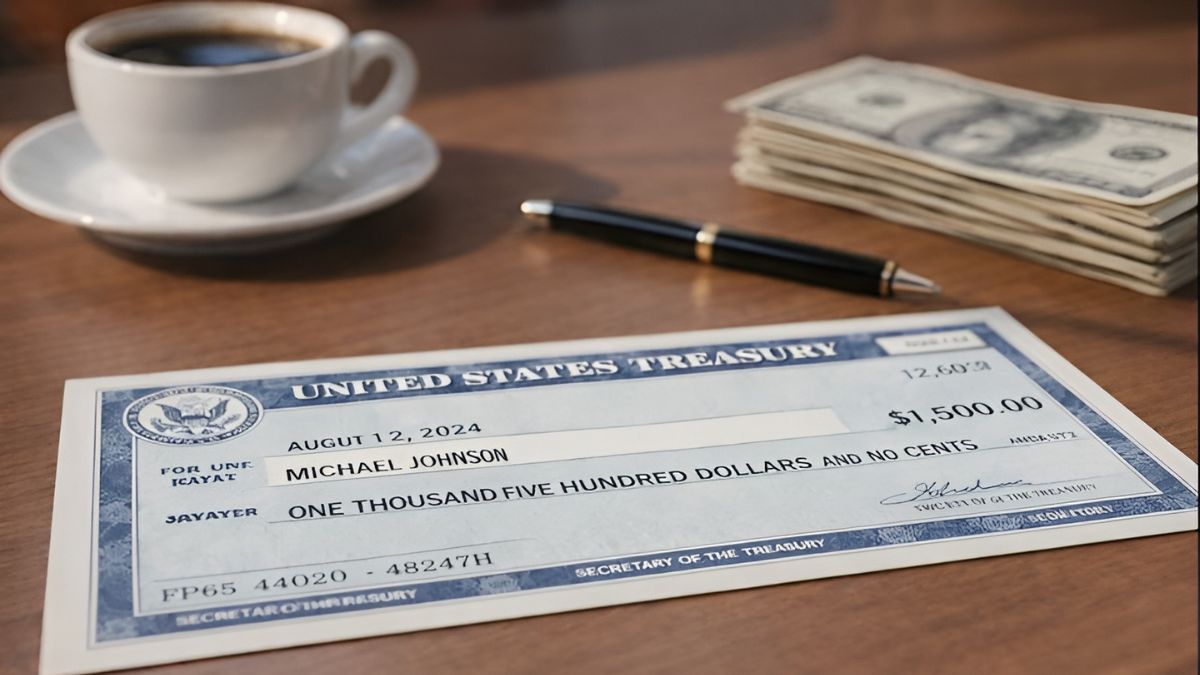

– Paper Checks: Checks may arrive via mail and typically take longer to clear.

– Prepaid Debit Cards: These may be issued for some programs; treat them like bank cards and safeguard your details.

Updating Payment Information for 2026

If you need to change your banking information or mailing address, do so through the official agency portal promptly. Avoid sharing personal information over the phone unless you can verify the party’s identity.

Steps to Update Your Payment Information:

1. Log into the agency portal (such as IRS, SSA, or VA).

2. Navigate to the settings for payments or your profile.

3. Enter your current banking details or new mailing address.

4. Confirm and save changes, and print or save a confirmation for your records.

Did You Know?

Many agencies have a status tracker for large one-time payments. Checking the official site can indicate whether your payment is “processing” or “sent” and provide delivery method details.

What to Do If You Haven’t Received Your Payment

If you expect the $2,000 payment but haven’t received it, start by checking the agency’s status page and any mailed notifications. If the status displays “sent,” but no funds are available, begin the dispute or trace process as outlined by the agency.

Common Steps to Address Missing Payments:

– Verify the payment method and address on file.

– Wait for a standard processing period (typically 7–21 days post “sent” status).

– Directly contact the agency using their official phone number or secure messaging center.

Case Study: Maria’s Payment Experience

Maria, a retired teacher, anticipated her $2,000 disbursement in January 2026. She verified her bank details on the Social Security portal ahead of time. After ten days without funds, she reached out to the agency’s helpline. A trace revealed a simple banking error that was rectified, allowing her to receive the funds shortly thereafter.

Tax Implications for the $2,000 Payment

Whether the federal payment is taxable will depend on current legislation. Consult the official guidance regarding its classification as taxable income or a tax-exempt rebate. Maintain records of any notifications received and work with a tax advisor for clarity on reporting obligations.

How to Recognize and Avoid Scams

Scammers may impersonate agencies to gather personal information. Be able to identify official communications, and never disclose your full Social Security numbers, banking PINs, or one-time passwords.

Watch Out For:

– Unexpected calls requesting immediate payment details.

– Emails prompting you to click links to provide bank account info without prior inquiries.

– Texts displaying urgent requests with strange URLs.

Always confirm using the agency’s verified contact information before replying to any solicitations.

Checklist Before January 2026

To ensure a smooth process, consider these practical steps:

– Confirm eligibility on the official agency website.

– Update your direct deposit details and mailing address, if necessary.

– Save confirmation resources or screenshots of your profile updates.

– Monitor for official notices and actively track payment status online.

– Promptly report any issues with missing payments through the agency’s tracing process.

This guide provides necessary steps to prepare for the Federal $2,000 Payments arriving in January 2026. Always reference the official federal agency overseeing the program for final rules and payment status. If you require assistance locating the correct portal or contact, refer to the verified agency website or consult a trusted financial advisor.